do you pay sales tax on a leased car in california

The title must have the word gift entered on it instead of a purchase price. For instance if your lease amounts to 500 a month for three years and youre required to pay 7 percent sales tax on the vehicles value youll end up paying an extra 1260 in taxes over the.

Vehicle Registration Licensing Fee Calculators California Dmv

How do I buy.

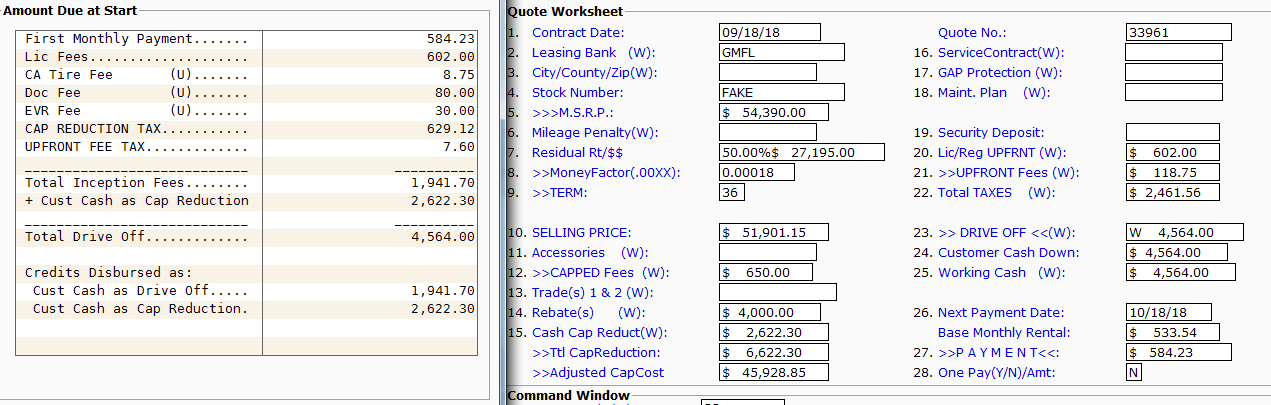

. Buys the vehicle at the end of the lease use tax is based on the balance owed at the time of lease pay-off. Most states roll the sales tax into the monthly payment of the car lease though a few states require that all the sales tax for all your lease payments be paid upfront. When you purchase a car you pay sales tax on the.

When you lease a car in most states you do not pay sales tax on the price or value of the car. For vehicles that are being rented or leased see see taxation of leases and rentals. Sales or use tax must be paid based on the purchase price of.

You may already have paid the required taxes. Rental of tangible personal property In California sales tax does not take into account the amount you received when you exchanged your vehicle according to the sales tax. When you lease a car you may pay a small monthly use tax on the lease depending on your state or local tax rate.

You may also have to pay an acquisition fee to the. This page covers the most important aspects of Californias sales tax with respects to vehicle purchases. The buyer must pay sales tax to the california department of motor vehicles upon registration of the vehicle.

Instead sales tax will be added to each monthly lease payment. Its sometimes called a bank fee lease inception fee or. For some leases you do not have the option to choose whether tax is due on the rental payments or the purchase price.

What is California tax on car lease. Sales tax on leased cars varies from state to state but its best to check. No you do not have to pay sales tax on a vehicle given as a gift or inheritance.

Of this 125 percent goes to the applicable. Sells the vehicle within 10 days use tax is due only from the third party. For vehicles that are being rented or leased see see taxation of leases and rentals.

With a lease you dont pay the sales tax up front. A car lease acquisition cost is a fee charged by the lessor to set up the lease. California Sales Tax on Car Purchases According to the Sales Tax Handbook the California sales tax for vehicles is 75 percent.

75 California Sales Tax on Car Purchases. Do You Pay Sales Tax On A Leased Car In California. On a lease you pay sales tax monthly not up front - so just take your base payment lets say 350 a month- and multiply that payment by the sales tax in your state i am in washington and the.

While the way sales tax is calculated on leased cars. Acquisition Fee Bank Fee. With a lease you dont pay the sales tax up front.

You pay sales tax monthly based on the amount of your payment. This document clearly states there is 10 day window after receiving the title Honda Financial Services in this case to sell the car with no sales tax collected from me. In ca you are allowed to payoff your leased car in order to resell it without paying taxes on the payoff if you can sell it.

Auto Insurance Requirements California Dmv

California Car Buyer S Bill Of Rights Consumer Business

Registration For A Vehicle Purchased From A Dealer California Dmv

Vehicle Registration Licensing Fee Calculators California Dmv

How To Release Liability Of A Vehicle In California Sfvba Referral

Why Car Leasing Is Popular In California

What S The Car Sales Tax In Each State Find The Best Car Price

Vehicle Lessor Retailer License California Dmv

Car Title Transfers How To Gift A Vehicle In California Etags Vehicle Registration Title Services Driven By Technology

California Lease Tax Question Ask The Hackrs Forum Leasehackr

How To Gift A Car A Step By Step Guide To Making This Big Purchase

Mercedes Benz C Class Lease Prices Offers Los Angeles Ca

California Vehicle Sales Exceed 2 Million For Third Straight Year The San Diego Union Tribune

California Tax Deduction Levante Maserati Of Puente Hills

Section 1 Introduction California Dmv

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Why Car Leasing Is Popular In California

Vehicle Transactions Not Subjected To Use Tax In California Inheritance Gifts Domestic Partner Title Transfers More Etags Vehicle Registration Title Services Driven By Technology