capital gains tax proposal details

Real estate or business interests would not be taxed annually Wyden said but billionaires would still pay a capital gains tax including an interest charge of 122 percent up. A Washington capital gains tax credit for.

The new tax would affect an estimated 58000.

. Investors currently pay a 238 top rate on long-term capital gains. The estate tax would revert to pre. The proposal includes a 3 surcharge on individual income above 5 million and a capital gains tax of 25.

Under the proposal the new top rate on capital gains could be as high as 318 when combined with the surtax and an existing 38 investment income tax. It would apply to single taxpayers with over 400000 of income and married. The UBS research note for instance expects legislators to compromise with a 28.

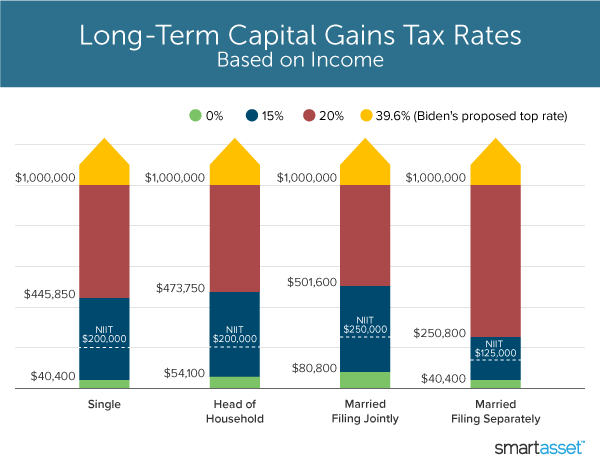

Long-Term Capitals Gains. Here are the top 10 new tax-related changes in the 175 trillion tax and spending plan that Levine pointed to in his Twitter thread not including retirement-related ones. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28.

This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket. That said Bidens plan for the long-term capital gains tax rate proposal is unlikely to pass as is. To increase their effective tax rate.

President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. Understanding Capital Gains and the Biden Tax Plan. House Democrats proposed a top 25 federal tax rate on capital gains and dividends.

53 rows Under Bidens proposal for capital gains the US. With average state taxes and a 38 federal surtax. President Biden on Monday unveiled a new minimum tax targeting billionaires as part of his 2023 budget request proposing a 20 rate that would hit both the income and.

When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. That includes a 20 capital-gains tax on assets held in taxable accounts for more than a. The proposals would increase the after-tax income of the bottom quintile by about 152 percent in 2022 on a conventional basis which is largely driven by the expanded child tax.

Taxes long-term capital gains and qualified dividends at the ordinary income tax rate of 396. Those earning income above 1 million would have their capital gainswhether short-term gains or long-term gainstaxed at 396 as well. The top capital gains tax rate would be 25.

The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. Democratic presidential candidate Hillary Clinton has proposed a change in the top capital gains tax rates. Capital gains tax.

Economy would be smaller American incomes. High-earning investors could be paying around 40 in federal capital gains taxes in the near future. Currently all long-term capital.

The current long-term capital gains tax rates are 15 20 or 238 for higher income taxpayers. Assets other than stocks may have different rates for capital gains taxes. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion.

Under current law such capital gains have a two-tiered structure. Understanding the Capital Gains Tax. Currently long-term capital gains and qualified dividends are taxed at a federal rate of 20 or 238 when combined with the 38 net.

President Joe Biden presented. A business and occupation BO tax credit for BO taxes due on the same sale or exchange which is subject to the Washington capital gains tax. It includes major revisions to the estate tax capital gains taxes and the way retirement accounts are taxed.

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

How Is Tax Liability Calculated Common Tax Questions Answered

Capital Gains Tax Examples Low Incomes Tax Reform Group

What S In Biden S Capital Gains Tax Plan Smartasset

Mutual Funds Taxation Rules Fy 2020 21 Capital Gains Dividends

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

Will Joe Biden S Proposed Taxes On Capital Make America An Outlier The Economist

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Why To Avoid 100 Of Agi Qualified Charitable Contributions Deduction Charitable Order Of Operations

Capital Gains Tax On Separation Low Incomes Tax Reform Group

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Exemption From Capital Gain Tax Complete Guide

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

All About Capital Gains Tax How To Calculate Income From Capital Gains Indexation Concept Youtube

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Calculation Of Ltcg Tax On Sale Of Shares Equity Mutual Fund Units 10 Ltcg Tax On Sale Of Stocks Equity Mutual Funds Budge Budgeting Mutuals Funds Equity

How Direct Taxation Impacts The Consumer Capital Gains Tax Indirect Tax Economic Research

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)